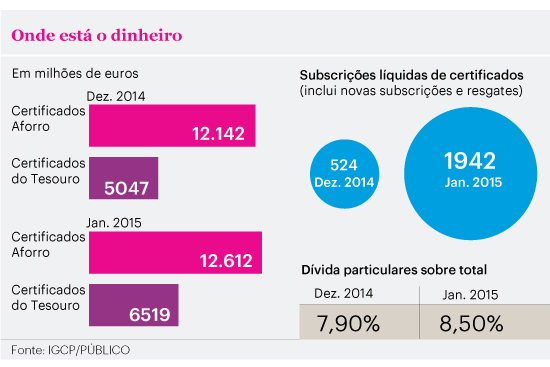

In January, the Portuguese signed in 1941 million euros in savings certificates and treasure, a historic value, explained by cutting ad remuneration rates, already in force this month.

In the last year, the value of public debt underwritten by households increased from 12,479 million to 19,131 million euros, up about 50%. In absolute terms, the Portuguese have never had so many savings applied to government bonds. The big bet has been in treasury certificates, which tripled in one year, from 2237 million to 6519 million.

The applications of individuals now account for 7.92% of 217 126 million of the total state debt. Without the loan from the troika , the percentage of debt held by individuals rose to 13.1%, the highest since 2009. The relative weight of public debt subscribed by individuals was already much higher, reaching exceed 21% in 2001, the year that the amount invested in savings certificates amounted to 13,858 million euros and the public debt was by 65 704 million.

The record January subscriptions was expected (although only yesterday the official figure has been released), given the influx abnormal checked the branches of CTT from the middle of the month to ensure the previous pay and conditions, which will remain for the duration of the product. The motto for the race was given by the statements of the Treasury secretary, Isabel Castelo Branco, announcing that the rates of return of state products would be cut from February.

In January, and following a trend that already was verified in the last year, investors’ preference again fall on the treasury certificates Savings Plus (CTPM), which attracted 1474 million, with only three million euros redemptions. Subscriptions to CTPM to five years, with higher interest rates now have a total balance of 6519 million, an increase of 29.2% compared to the end value 2014.

Certificates of savings (CA), a product of application to ten years, captured 646 million new subscriptions, but suffered 176 million in redemptions, which reduces the net value of subscriptions for 470 million euros. As the PUBLIC had reported, many savers raised CA to subscribe CTPM. The traditional CA, with lower rates, but greater flexibility in handling and subscription amount, totaled 12,612 million euros, up 23% on the same period 2014.

For the increase in savings entrusted by the Portuguese state contributed to the strong profitability of public goods, improved substantially in late 2012, when the country was forced to pay high rates in the debt market. This preference was even indirectly encouraged by the low remuneration of time deposits of banks. According to a recent analysis of Deco Protest, a deposit of 5000 euros to 12 months yields an average rate of 0.7% net.

The figures released yesterday by the IGCP, the agency that manages the debt public, show that the Government has in just a month most of the 2.5 billion euro wanted to capture through individual savers this year. Data February should reveal a marked reduction of subscriptions, reflecting the sharp drop in return rates announced by the IGCP. This, despite the rates offered by traditional bank deposits continue very low.

The savings certificates, which guaranteed a gross rate of 3.069% per year, grouped because a fixed premium of 2.75% that acrescia the Euribor three months pass to grant interest 1,058% gross. The new Series D, now released, offers 1% fixed rate plus the Euribor three months and 0.5% remaining premiums (from 2 to 5 years) and 1% (of 6 the 10th). The average net value (applied to flat rate of 28%) falls to 0.762% in the first year, 1.122% of 2 to 5 and 1,482% from the 6.

Now the treasury certificates Saving More, which have a maturity of five years and offering an average net rate of about 3% per year, see the remuneration fall to a final average also net of 1.62%. The gross, without withholding tax, starts at 1.25% in the first year, and rises to 3.25% in 5, which represents an average gross rate of 2.25%. with Luis Villalobos and Sergio Anibal

No comments:

Post a Comment